Instant billings

General

To correct storage fee billings (also later service fee billings) or simply to enter manual invoices, the user needs a tool with which he can create credit notes or manual invoices.

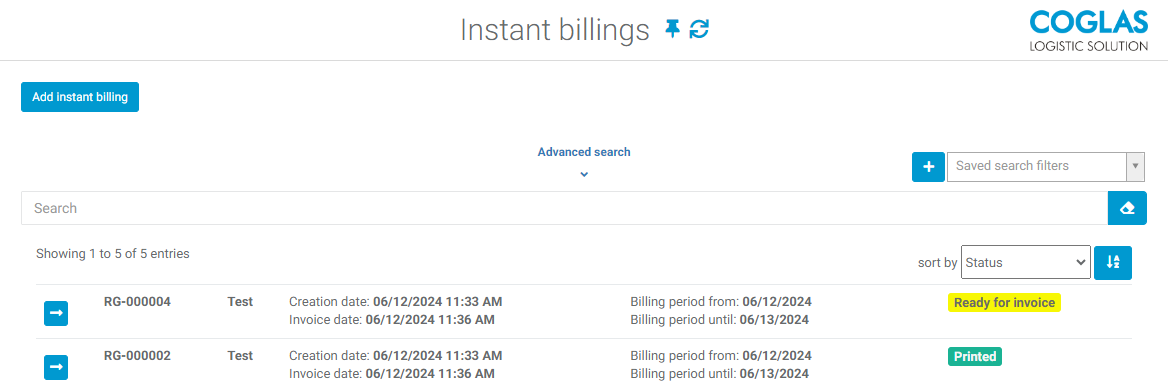

Overview

The instant billings are displayed one below the other as a list in the overview.

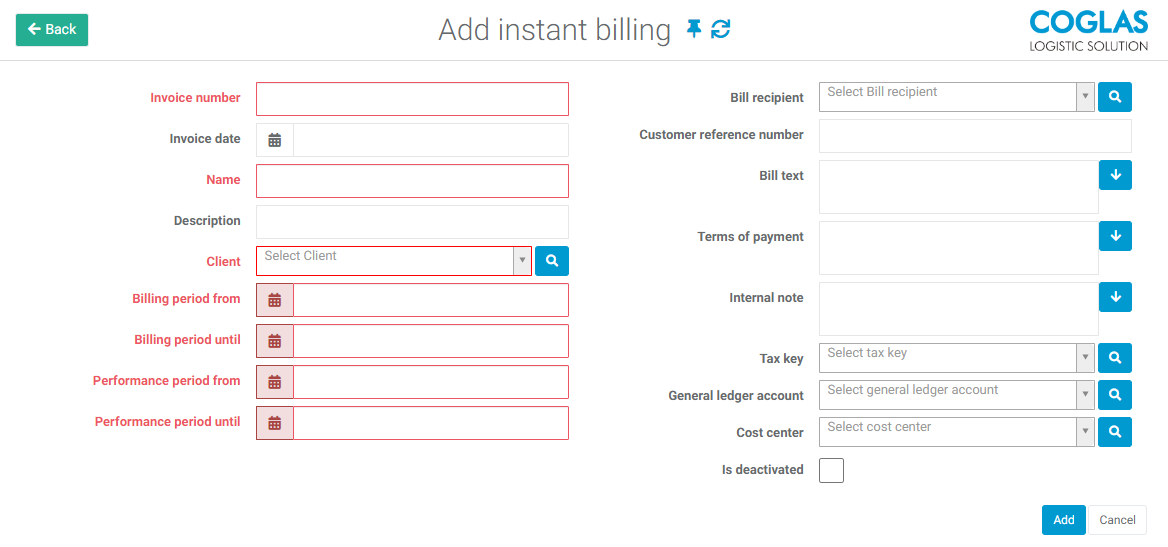

Add Instant billing

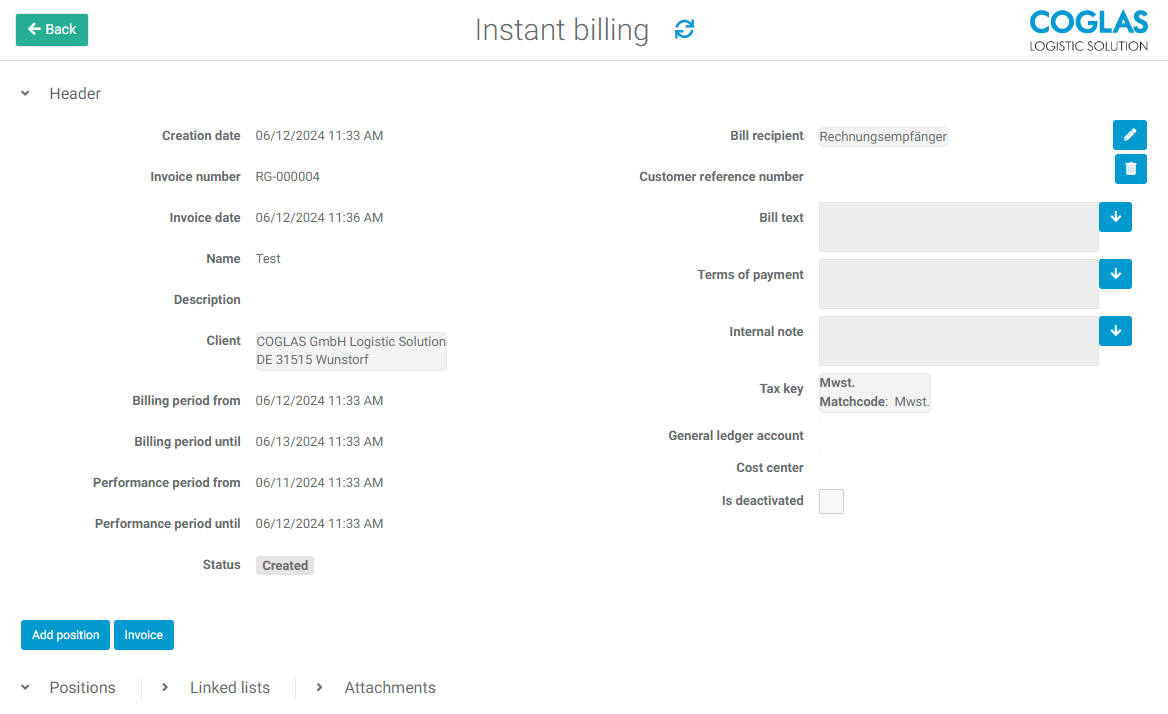

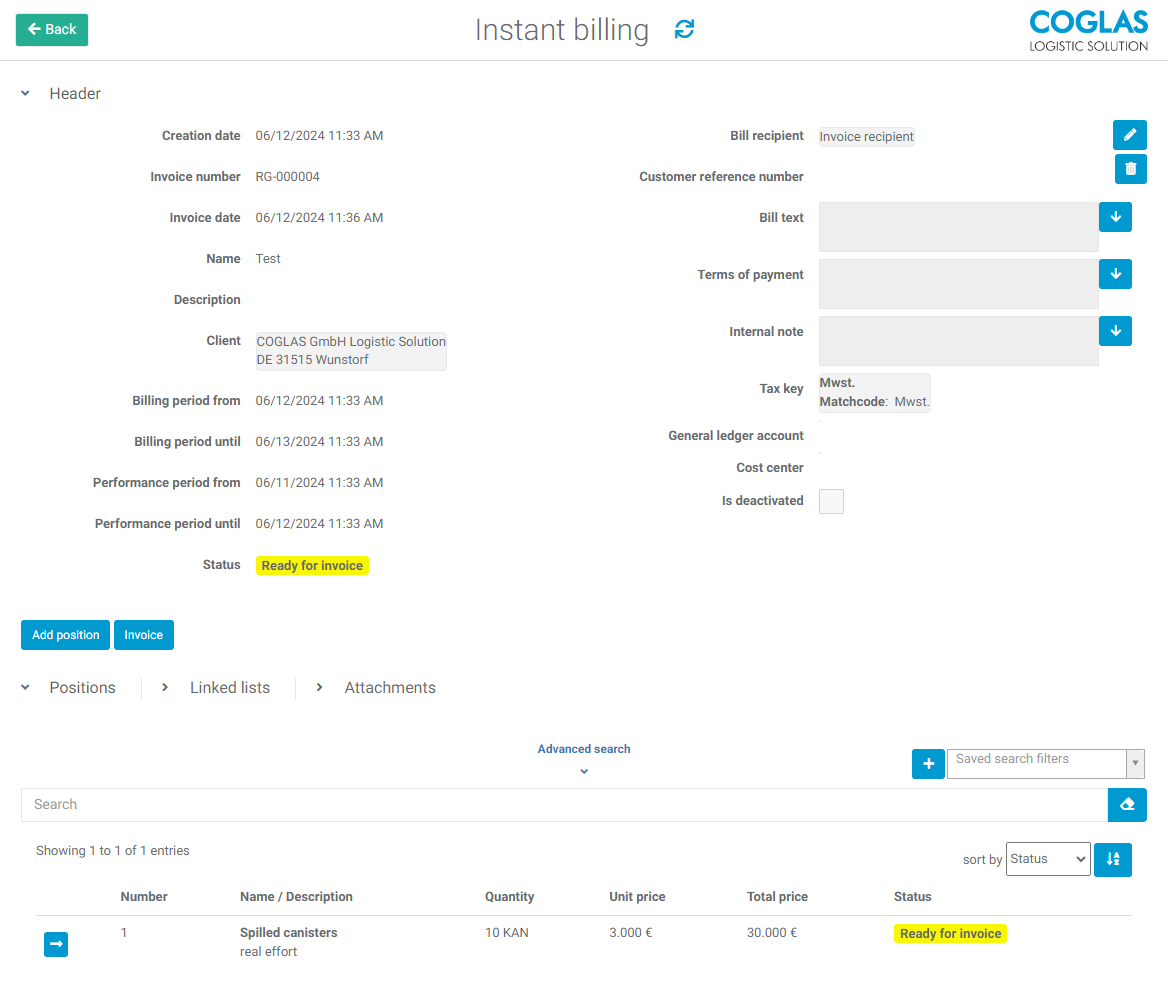

Firstly, all header data for the instant billing is defined. The fields marked in red are mandatory fields. These include the following points:

Field | Description |

|---|---|

Creation date | Creation date of the invoice |

Invoice number | either Temp+invoice number (status ready for invoice) or real invoice number (status invoiced) |

Invoice date | The date of performance to be shown on the invoices is the time at which a delivery is recognised for VAT purposes. A misjudgement of the date leads to incorrect VAT returns and invoices. When an invoice is first created, the invoice date is never filled in; it can be entered manually. If an invoice is to be created without the invoice date being filled in, a warning is displayed to the user indicating this fact. |

Name | Unique name for this invoice |

Description | Textual description of the invoice |

Client | Selection of a client for this invoice |

Billing period from | The billing period from indicates the start date of the billing period. |

Billing period until | The billing period to indicates the end date of the billing period. |

Performance period from | The service period from specifies the start date of the service provision. |

Performance period until | The service period to specifies the end date of the service provision. |

Status | Created, Ready for invoice, Invoiced, Printed, Cancelled |

Bill recipient | The invoice recipient of the invoice, there must always be one. The invoice recipient is usually the client who has received a specific delivery or service. |

Customer reference number | A reference number for this invoice, which is also printed. |

Bill text | Continuous text for outputting an invoice text on the invoice |

Terms of payment | Continuous text for outputting the terms of payment on the invoice |

Tax key | Tax keys ensure that the business transactions are shown in the correct position in the advance VAT return and that the tax is calculated correctly. If required for the accounting interface, tax keys can be created and managed under System - Tax keys. |

General ledger account | In accounting, a General ledger account is any general ledger account that is included directly in the balance sheet or income statement. If required for the accounting interface, it can be created and managed under System - General ledger account. |

Cost center | This is a place in the company where costs are incurred and services are provided. Cost centres can be departments or areas of responsibility and can be formed according to functional, spatial or other aspects. Is required for the accounting interface, can be created and managed under System - Cost center. |

Is deactivated | Invoice is applicable (deactivated = FALSE) |

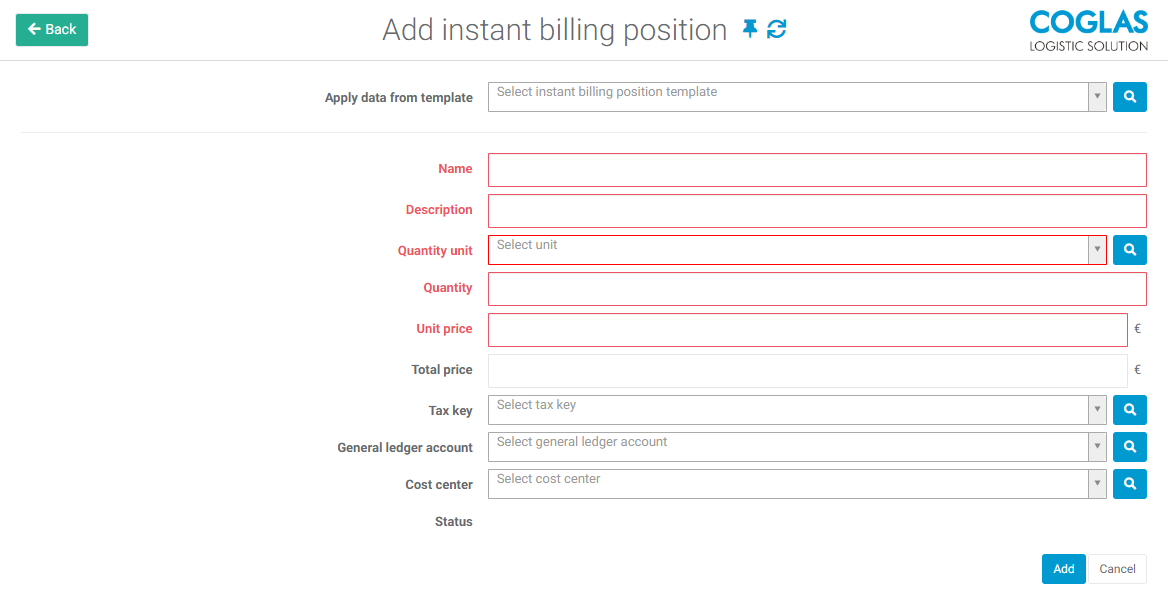

Items to be invoiced can now be added to the instant invoice.

If instant invoice item templates have already been created, you can fill in the predefined fields by selecting ‘Copy data from template’.

Field | Description |

|---|---|

Apply data from template | Selection of an instant billing position template |

Name | Unique name for this invoice |

Description | Textual description of the invoice |

Quantity unit | The unit of measure of the position |

Quantity | The quantity of the position |

Unit price | Price per unit in € |

Total price | If the quantity and price per unit are not set, a total price can be specified. |

Tax key | Tax rate, selection from the previously stored tax key |

General ledger account | General ledger account, selection from the previously stored general ledger accounts |

Cost center | Cost center, selection from the previously stored cost centre |

Status | The status of the position |

Create invoice

Process | Description |

|---|---|

Create invoice | The added header and item data are added to the invoice. |

→ back to COGLAS processes

→ back to COGLAS menu