Reports

General

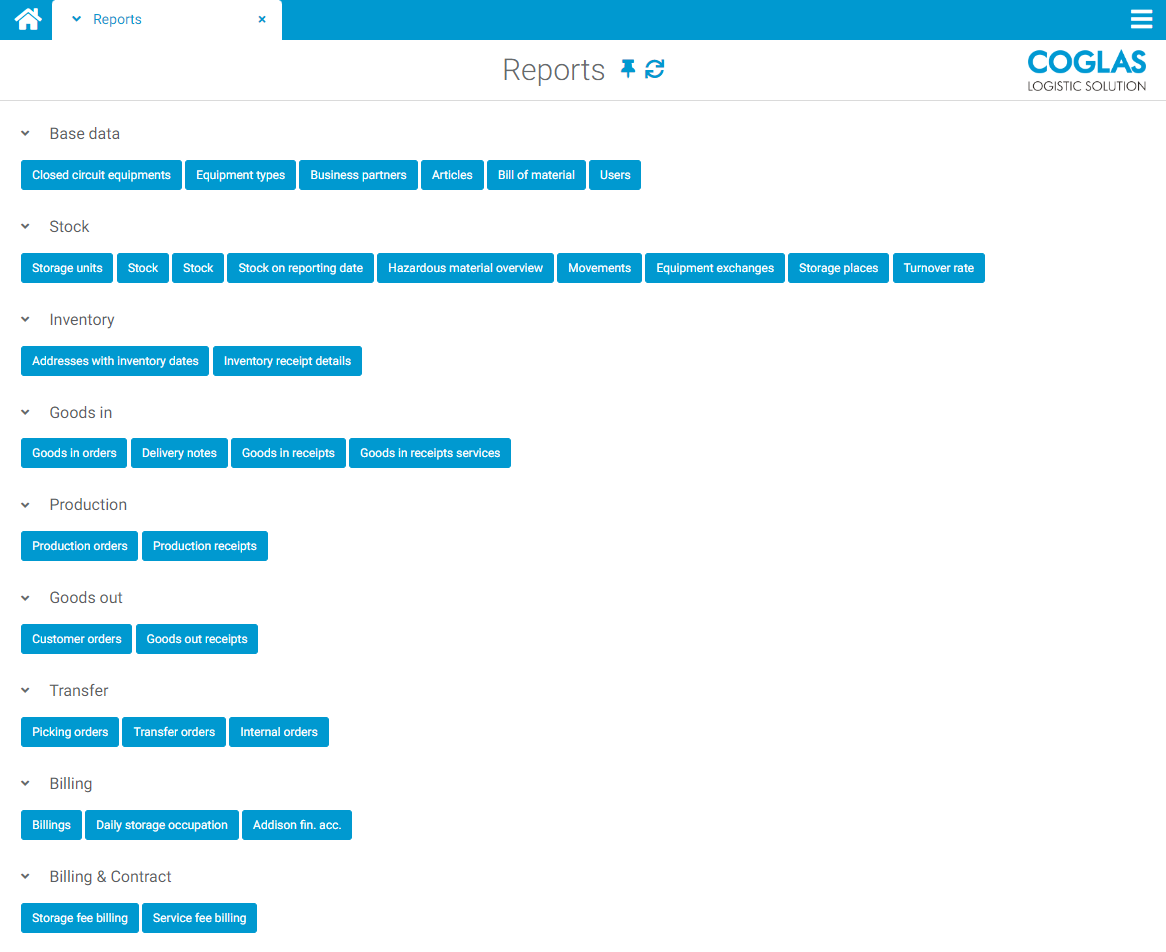

A multitude of reports are available that can be exported from the system. These are provided as .xlsx files for download.

For some lists, the data can be restricted via a filter before downloading.

Reports are reports about e.g. all article stocks in the warehouse, hazardous materials etc.. They can be created at any time.

Structural changes may occur in the reports at any time. For example, new columns.

Addison FiBu

This report generates CSV files with accounting data for import into the Addison financial accounting system.

In the report, the data of the billing is linked and output according to the specifications of the Addison financial accounting software:

Column A contains the record type, i.e. always a B for posting.

The FiBu account number of the warehouse manager is always written in column B.

Column C shows the posting date.

Column D contains the document date of the invoice, whose invoice number you can find in column E.

The posting text in column F throws out the rate types in summary.

Column G shows the amount.

Column H indicates the account of the business partner that will be charged, or the revenue, or the sales tax account.

Column I contains a 0 or the contra account from the first line of the corresponding posting record, i.e. the FiBu account number of the settled business partner.

In column J the tax key is output with 0, because the tax of the posting record, if sales tax is calculated, is written in a separate line.

Columns K and L are not filled because they are not used in COGLAS.

A posting record extends over three lines if VAT is calculated. Without VAT accordingly on two lines.

In the first row, the account of the business partner (column H) with the gross or, if no sales tax is charged, net amount (column G) written against contra account 0.

In the second line, the net revenues are shown as a minus amount (column G) with the revenue account (column H) against the contra account (column I), which was defined in the previous line as an account (column H) is led, written.

In the third line of the posting record, the VAT amount is entered as a minus amount (column G) with the sales tax account (column H) against the contra account (column I), which is displayed in the first row as an account (column H) is led, written.

→ back to COGLAS processes

→ back to COGLAS menu