Storage fee billings

General

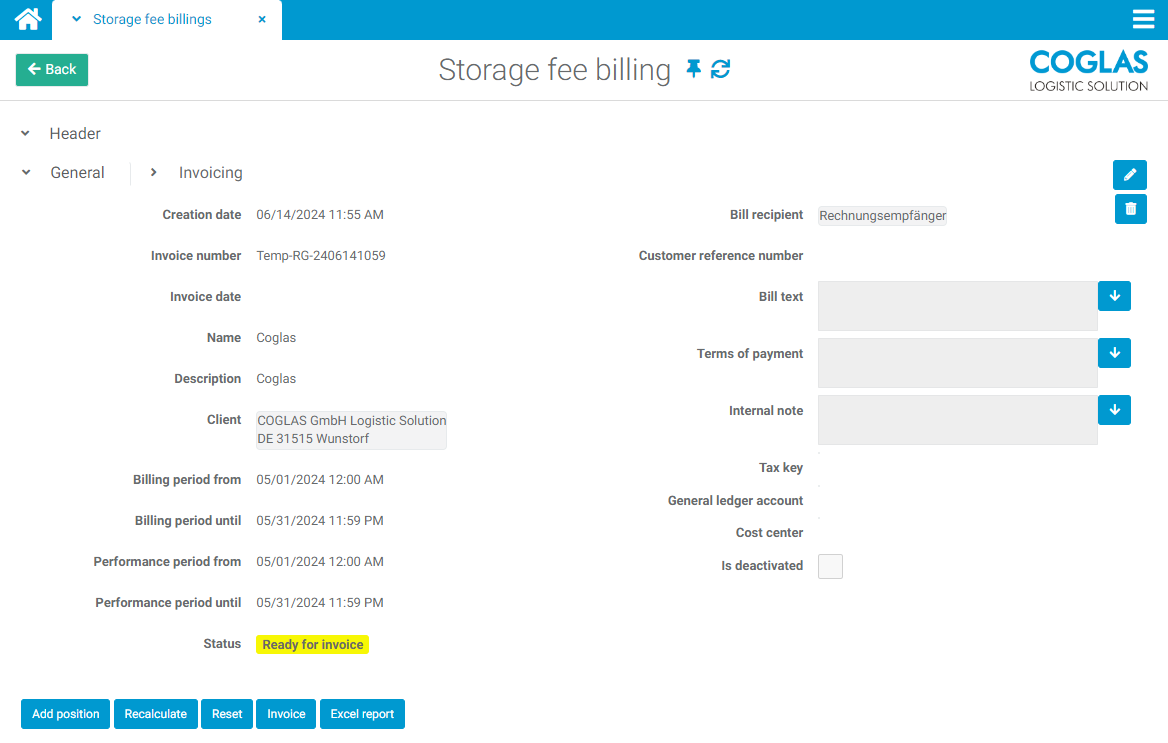

A billing is defined by a period or by a default (daily, every 14 days, monthly) for a client. In addition, there are the billing rules stored for this billing.

Each invoice has a unique, consecutive invoice number. This can be specified initially (prefix + number, 6 digits, e.g. LG000001). (Business partner - warehouse operator) (It is specified that it is used as a consecutive and unique identifier for the calculation of a delivery or other service The invoice number is an identifier consisting of numbers and/or letters that a company assigns to uniquely identify an outgoing invoice. According to §14 of the Value Added Tax Act, this is mandatory information for the issuing company. )

It is valid for all clients and applies per warehouse.

An invoice can be generated from a warehouse invoice template using "Create Billing".

All completed fields from the template are transferred to the invoice.

The billing and service periods are pre-filled from the selection of the billing period daily, half-monthly, monthly.

Billing period | Info |

|---|---|

Daily | Last working day |

Semi-monthly | 1st of the previous month to 15th or 16th to last day of the previous month |

Monthly | 1st of the previous month to last of the previous month |

Based on the predefined time periods, the settlement items for the storage money rules are calculated directly.

Field | Description |

|---|---|

Creation date | Creation date of the invoice |

Invoice number | either Temp+invoice number (status Ready for invoice) or real invoice number (status invoiced) |

Invoice date | The service date to be shown on the invoices is the time at which a delivery is recognised for VAT purposes. A misjudgement of the date leads to incorrect VAT returns and invoices. When an invoice is first created, the invoice date is never filled in; it can be entered manually. If an invoice is to be created without the invoice date being filled in, a warning is displayed to the user indicating this fact. |

Name | Unique name for this invoice |

Description | Textual description of the invoice |

Client | Selection of a client for this invoice |

Accounting period from | The accounting period from specifies the start date of the accounting period in which data is to be searched for in the storage money collection using the rules. |

Accounting period to | The accounting period to specifies the end date of the accounting period in which data is to be searched for in the storage money collection using the rules. |

Service period from | The service period from indicates the start date of the service provision. |

Service period until | The service period to indicates the end date of the service provision. |

Status | Created, Ready for invoice, Invoiced, Printed, Cancelled |

Invoice recipient | The invoice recipient of the invoice, there must always be one. The invoice recipient is usually the client who has received a specific delivery or service. |

Customer reference number | A reference number for this invoice, it will be printed with the invoice. |

Invoice text | Continuous text for outputting an invoice text on the invoice |

Terms of payment | Continuous text for outputting the terms of payment on the invoice |

Tax key | Tax keys ensure that the business transactions are shown in the correct position in the advance VAT return and that the tax is calculated correctly. They are required for the accounting interface and can be created and managed under System - Tax keys. |

General ledger account | In accounting, a general ledger account is any general ledger account that is included directly in the balance sheet or income statement. It is required for the accounting interface and can be created and managed under System - general ledger account. |

Cost centre | This is a place in the company where costs are incurred and services are provided. Cost centres can be departments or areas of responsibility and can be formed according to functional, spatial or other aspects. Is required for the accounting interface, can be created and managed under System - Cost centre. |

Deactivated | Invoice is applicable (deactivated = FALSE) |

Functions

Process | Description |

|---|---|

Add position | A manual invoice item can be added Can only be done in status = Ready for billing or Created |

Recalculate | The determination of the performance results is carried out again Can only take place in status = Ready for billing |

Reset | The invoice is reset Status = Created |

Create invoice | The calculated service results are added to the invoice. New status = billed |

Excel report | An Excel report is created and output for the storage money invoice |

Cancellation | The invoice will be cancelled |

Add invoice immediately | An immediate invoice can be generated from the header data of this invoice |

Print invoice | The invoice is sent to paper via a report New status = printed |

Edit

The above fields can be changed in the invoice header. If the invoice period is adjusted, the invoice is recalculated. Changes are only permitted as long as an invoice does not have the invoiced/cancelled status.

Delete

An invoice can be deleted in the created status.

Reset

An invoice with the status Ready for invoicing can be reset: The SUs/Quants assigned to the invoices are then available again for a new invoice, possibly also modified in the invoicing rules.

Recalculate

The invoice run to determine the respective quants/LE is restarted and recalculated

Create invoice

The storage money invoice is finalised by triggering this process: All assigned LE/Quants are then no longer available for a new invoice, possibly also modified in the invoicing rules. The status changes to invoiced. All billing rules assigned to this invoice can no longer be changed, as they have a direct reference to the invoice.

Excel report

After a storage fee has been (re)calculated, an Excel report can be created. The name of the generated Excel file always contains the invoice number to enable better separation of the reports.

Column Inbound date:

The date corresponds to the inbound entry in the zone ID “Storage fee”.

Situation = Inbound date is empty.

Cause = The business partner - Client Option “Enable Billing & Contract storage fee“ was started subsequently. Actual stock is recorded during activation, but the actual date of receipt is not subsequently determined. The Inbound date is not set as it does not reflect the actual date of the inbound. The Inbound date therefore remains blank.

Research possible via the Revision history (type = Business partner).

Column Outbound date:

Das Datum entspricht der Ausgangsbuchung aus der Zonen ID “Lagergeld”.

Situation = Ausgangsdatum ist leer.

Der Ladungsträger befindet sich noch im Bestand.

Die Recherche in der Lagerübersicht sollte Aufschluss geben.

The date corresponds to the outbound entry from the zone ID “Storage fee”.

Situation = Outbound date is empty.

The storage unit is still in stock.

The search in the warehouse overview should provide information.

Cancellation

Settlements that have already been settled can be cancelled. The SU/quants assigned to the settlements are then available again for a new settlement, possibly modified in the settlement rules.

→ back to COGLAS processes

→ back to COGLAS menu